VIDEO TIPS: EITC AWARENESS CAMPAIGN FROM THE IRS

The IRS on January 27 kicked off an Awareness outreach campaign to help Americans to take advantage of…

The IRS on January 27 kicked off an Awareness outreach campaign to help Americans to take advantage of…

If you are a grandparent there are several things you can do to teach your grandchildren financial responsibility…

2023 brings with it a whole new set of rules related to qualifying for a tax credit for purchasing a…

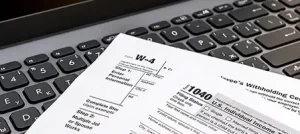

With tax season upon us, documents reporting income, sales and other items needed for your 2022 tax return…

If you are a divorced or separated parent, a commonly encountered but often misunderstood issue is who…

Although the credit for purchasing a new electric vehicle can still be as much as $7,500, Congress has…

Married taxpayers generally have the option to file a joint tax return or separate returns, a filing…

Individuals and small businesses should consider various ways of starting off on the right foot for the…

Individuals are always looking for tax deductions that can reduce their tax liability. But what is the…